#Hedonic method tv

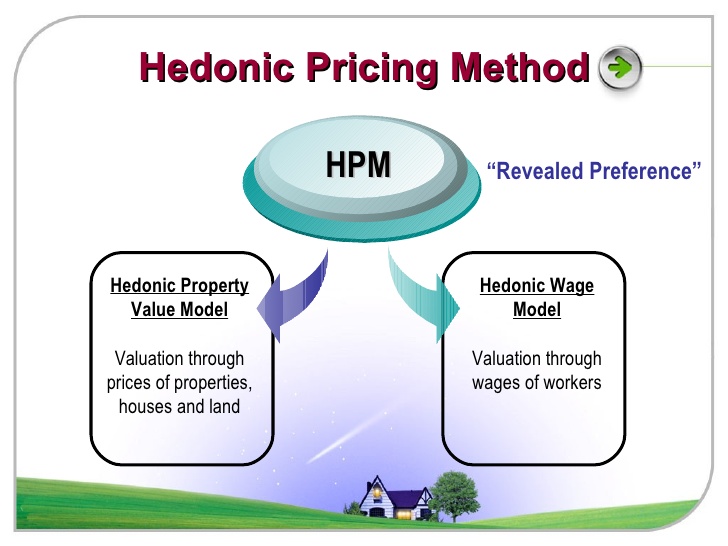

The basic idea of this technique is that prices of land and properties (house). Hedonic model for LCD TV sets Time Dummy Variable Method (pooled approach) dependent variable: ln(PRICE) estimation method: WLS n 8 159. We illustrate this process using several recent papers from the literature. The hedonic pricing method (HPM) is also known as the property value technique.

#Hedonic method series

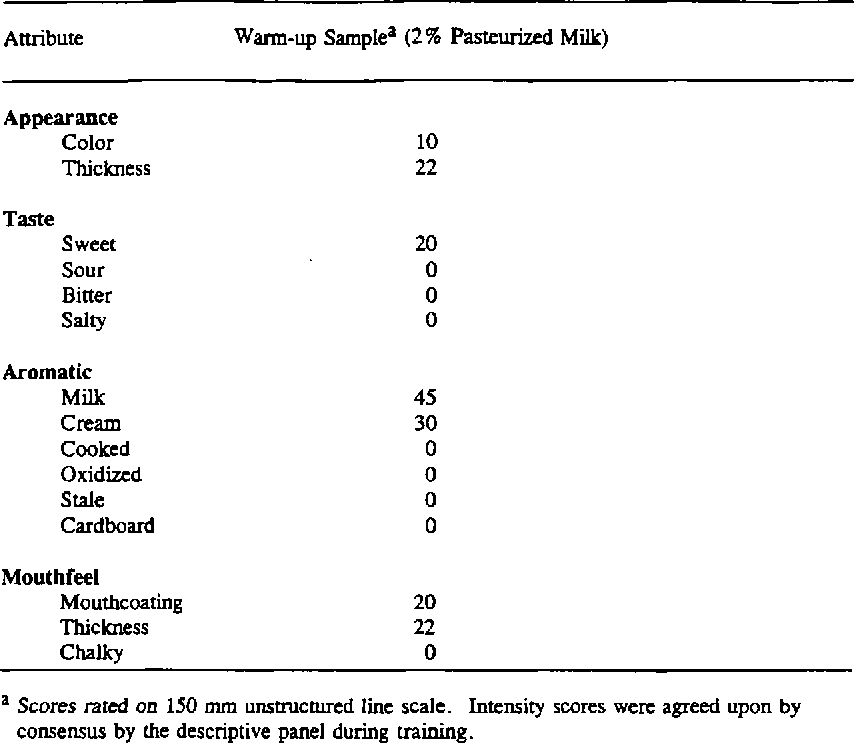

This is done by focusing on a series of steps that can help to ensure the reliability of a quasi-experimental identification strategy. It is done to determine the contributory value of each characteristic separately through regression analysis. The chapter also provides a practical "how to" guide on implementing a quasi-experimental hedonic analysis. The hedonic regression method is a regression technique used to determine the value of a good, service, or asset by fractionating the product into constituent parts or characteristics. By connecting these two literatures, the underlying theoretical and empirical assumptions necessary to derive welfare measures or capitalization rates become more apparent. An effort is made to provide background information on the traditional hedonic theory, the traditional cross-sectional hedonic methods as well as the newer quasi-experimental hedonic methods that use program evaluation techniques. The purpose of this chapter is to fill this void. When running this type of model, if non. First section of working paper has been devoted to.

While the empirical literature has developed extensively, there has not been a consistent treatment of the theory and methods of combining hedonic property models with quasi-experiments. The hedonic pricing model is used to estimate the extent to which each factor affects the market price of the property. Hedonic price method helps in defining the influence of these characteristics on the price of houses. Hedonic pricing methodologies are a prominent approach in this area, which allow not only to compile house price data controlling for quality differences. This is largely due to the concern that cross-sectional hedonic methods may be severely biased by omitted variables.

There has recently been a dramatic increase in the number of papers that have combined quasi-experimental methods with hedonic property models.

0 kommentar(er)

0 kommentar(er)